Get the free uia form 1020

Show details

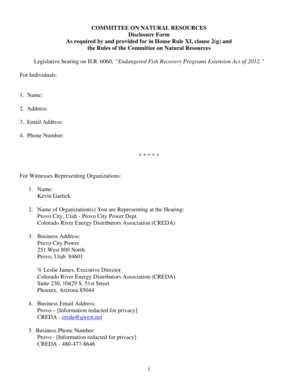

UIA 1538 (Rev. 11-11) State of Michigan Department of Licensing and Regulatory Affairs Unemployment Insurance Agency Reset Form Authorized by MCL 421.1, et seq. What You Need To File An Unemployment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your uia form 1020 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your uia form 1020 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing uia form 1020 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit michigan ui uia 1538 rev 05 15 form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

How to fill out uia form 1020

How to fill out uia 1020:

01

Gather all the necessary information and documents required to complete the form.

02

Start by providing your personal details, such as your full name, address, and contact information.

03

Proceed to fill out the sections related to your employment history and income information. Include details about your previous employers, dates of employment, and salary or wages earned.

04

If you have any dependents, make sure to accurately provide their information as well.

05

Next, outline any additional sources of income or benefits you may be receiving.

06

Review the completed form for accuracy and ensure that all required fields are filled out properly.

07

Sign and date the form before submitting it to the appropriate agency or organization.

Who needs uia 1020:

01

Individuals who are applying for unemployment benefits.

02

Those who have recently lost their job and are seeking financial assistance.

03

Individuals who meet the eligibility criteria set by the relevant government agency or department.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is uia 1020?

UIA 1020 stands for User Interface Automation (UIA) namespace 1020. UIA is a framework provided by Microsoft that allows accessibility automation of user interfaces. The namespace 1020 refers to the specific element identification and control patterns provided by UIA for a particular user interface element or feature.

Who is required to file uia 1020?

The UIA (Unemployment Insurance Agency) 1020 form is required to be filed by employers in the state of Michigan. This form is used to report the wages paid and the number of employees for each quarter.

How to fill out uia 1020?

To fill out the UIA 1020 form, also known as the Notice of Unemployment Insurance Claim Filed, follow the steps below:

1. Obtain the form: You can download a fillable PDF version of the form from the official website of the Michigan Unemployment Insurance Agency (UIA).

2. Provide personal information: Enter your full name, mailing address, and social security number in the designated fields. Include your date of birth and gender as well.

3. Enter contact details: Include your phone number and email address where the UIA can reach you.

4. Complete employment details: Fill out your last employer's name, address, and phone number. Provide the dates of your employment and the reason for separation.

5. Provide additional employer information: If you had multiple employers in the past 18 months, continue providing information for each employer, including their details and separation reasons.

6. Wage information: Enter your wages for the last week you worked and include any vacation pay, severance pay, or holiday pay you may have received.

7. Include any pension or retirement income: If you are receiving a pension or retirement income, you must report it on the form. Provide details of the income received and whether it is taxable.

8. Certification and signature: Read the certification statement on the form and sign and date the document to certify that the information you provided is accurate and complete.

9. Review and submit: Before submitting your form, review all the information to ensure accuracy and completeness. Submit the form as directed by the UIA.

It is important to note that specific instructions may vary depending on your state's unemployment insurance agency. It's advisable to refer to the official UIA instructions or guidelines for more precise instructions for your state.

What is the purpose of uia 1020?

UIA 1020 (also known as the Unemployment Insurance Amendment Act of 2012) is a legislation in South Africa that aims to address various issues related to unemployment insurance. The purpose of UIA 1020 is to enhance the effectiveness and efficiency of the country's unemployment insurance system. It seeks to provide better protection to the unemployed by improving the accessibility and coverage of unemployment benefits, streamlining administrative procedures, and addressing challenges relating to fraud and mismanagement in the unemployment insurance fund. The act also introduces provisions for the upskilling and training of unemployed individuals to facilitate their reintegration into the labor market. Ultimately, the purpose of UIA 1020 is to mitigate the negative impacts of unemployment and support individuals in their job search and transition.

What information must be reported on uia 1020?

The UIA 1020 form is used for the quarterly wage and contribution report in the state of Michigan. Some of the information that must be reported on this form includes:

1. Business information: Name, address, and federal employer identification number (FEIN) of the employer.

2. Employee information: Name, social security number, and total wages paid during the quarter for each employee.

3. Gross wages: Breakdown of gross wages paid, including regular wages, overtime wages, sick pay, tips, and any other compensation.

4. Deductions: Include any deductions made from employee wages such as taxes, insurance, retirement contributions, or other authorized deductions.

5. Employer contributions: Report any employer contributions made to retirement plans, health insurance plans, or other employee benefits.

6. Breakdown of hours worked: Provide the number of hours worked by each employee during the quarter.

7. Employer tax information: Report any unemployment insurance tax liability, interest, or penalties incurred during the quarter.

8. Signature and date: The form must be signed and dated by an authorized representative of the employer.

It is essential to accurately report this information to ensure compliance with state unemployment insurance requirements and to calculate the correct UI tax liability.

How can I modify uia form 1020 without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your michigan ui uia 1538 rev 05 15 form into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I complete uia 1020 online?

pdfFiller has made it simple to fill out and eSign uia form 1020. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I sign the michigan ui uia 1538 rev 05 15 form electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your uia 1020.

Fill out your uia form 1020 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Uia 1020 is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.